How to Pick the Right Automobile Money Choice for Your Spending Plan

Various financing options, from finances to leases, existing unique advantages and drawbacks that call for cautious consideration. Evaluating interest prices and added expenses is vital in figuring out the most appropriate path forward.

Recognizing Your Spending Plan

When taking into consideration cars and truck finance choices, understanding your budget plan is crucial to making notified choices. A comprehensive budget plan analysis allows you to figure out just how much you can afford to spend on a lorry, including regular monthly settlements, upkeep, fuel, and insurance expenses.

Following, take into consideration the complete cost of ownership, which encompasses not only the automobile's rate yet also continuous costs. Consider insurance policy costs, enrollment fees, and potential repairs. Furthermore, know the rates of interest linked with various funding alternatives, as they can significantly impact your general expenditure.

It is recommended to reserve a deposit, as this can lower the finance amount and as a result reduced regular monthly repayments. Furthermore, maintaining a healthy and balanced credit rating can boost your funding choices, potentially securing more favorable prices. By plainly outlining your economic specifications, you can confidently browse the auto funding landscape and select an alternative that straightens with your long-lasting economic objectives.

Review of Financing Options

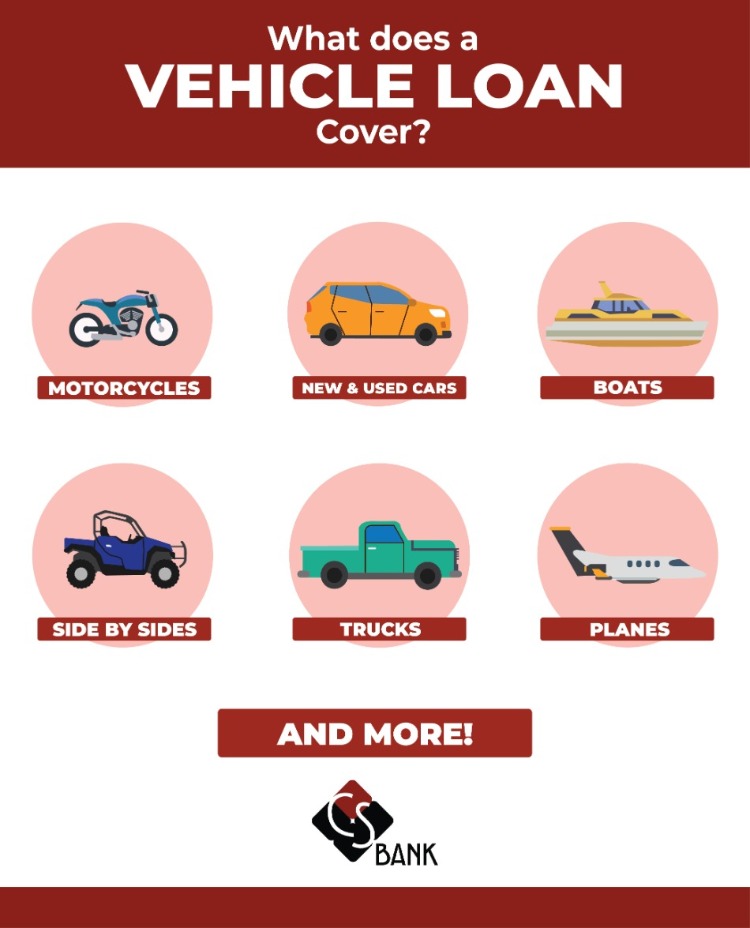

Discovering cars and truck financing alternatives entails comprehending the various techniques available to money your car acquisition. The most usual funding methods consist of car loans, leases, and cash acquisitions. Each option has unique features that provide to different monetary situations and choices.

An automobile loan is a preferred choice, permitting buyers to borrow funds from a bank or cooperative credit union to buy a car. With this option, you possess the automobile outright once the funding is paid off, normally over several years. Additionally, renting involves renting the automobile for a defined term, usually two to 4 years, with reduced monthly repayments however no possession at the end.

Cash purchases need the purchaser to pay the complete cost upfront, removing any kind of monthly payment obligations and rate of interest fees. This choice is suitable for those that have enough savings and prefer to avoid debt.

Additionally, dealer financing may be available, where dealerships companion with banks to supply lendings directly to customers. Understanding these funding alternatives is crucial in making educated choices that line up with your budget plan and monetary goals, inevitably bring about an extra gratifying car-buying experience.

Examining Finance Terms

Following, analyze the settlement structure. Fixed-rate image source finances maintain the exact same passion rate throughout the term, supplying predictability in budgeting. Alternatively, variable-rate fundings check this might begin reduced but can vary, posturing potential monetary dangers as prices change.

In addition, be cautious about charges that might come with the lending. Origination charges, prepayment penalties, or processing fees can pump up the complete price of borrowing. Understanding these terms assists in precisely contrasting various funding alternatives.

Contrasting Interest Rates

Navigating the landscape of interest rates is vital for making notified choices regarding auto funding (Car Finance). Passion prices can significantly affect your monthly payments and the total price of the vehicle over time. It is critical to contrast prices from different loan providers to secure the best bargain.

When contrasting rate of interest, consider both the Annual Percent Price (APR) and the nominal interest rate. The APR incorporates not just the rate of interest charged on the loan but additionally any kind of connected fees, providing an extra precise representation of the loan's price. Furthermore, be aware of the distinctions in between fixed and variable prices. Fixed prices stay continuous throughout the lending term, while variable prices may change, potentially raising your repayments.

.jpg)

Assessing Extra Expenses

Recognizing the numerous additional costs related to auto financing is essential for a precise evaluation of your complete spending plan. Past the principal funding quantity and rates of interest, several elements can affect your general expense.

To start with, think about insurance coverage prices, which can differ significantly based on the vehicle type, your driving history, and coverage level. Costs are a vital part of vehicle ownership and ought to be factored into your monthly budget. Additionally, tax obligations and enrollment costs usually come with lorry acquisitions, which can lead to a considerable in advance expense.

Upkeep and fixing expenses are one more vital consideration. New vehicles may feature service warranties that cover specific repair work, but regular upkeep stays a repeating expense. In addition, gas costs can fluctuate based upon your driving routines and the car's performance.

Last but not least, understand prospective funding charges, such as car loan source charges or prepayment charges, which could include to your overall price. By evaluating these additional expenses comprehensively, you will certainly be better furnished to select a get redirected here funding option that straightens with your financial situation and long-lasting goals.

Verdict

In verdict, picking the ideal auto money alternative calls for a thorough analysis of private monetary situations, including income, expenditures, and existing commitments. A detailed understanding of numerous financing options, along with careful evaluation of loan terms and passion prices, is vital.

When comparing interest prices, think about both the Annual Percent Price (APR) and the nominal interest price. Taken care of rates remain consistent throughout the finance term, while variable rates might vary, possibly raising your repayments.

Your debt rating plays a vital function in establishing the rate of interest rate you are used; higher ratings usually produce lower prices (Car Finance). By vigilantly contrasting rate of interest prices, you can choose a funding choice that straightens with your budget plan and economic goals, hence optimizing your car-buying experience

A detailed understanding of different funding options, along with mindful evaluation of financing terms and interest prices, is essential.

Comments on “Just how to Choose a Car Finance Strategy That Fits Your Needs”